As discussed earlier, with rising input costs for Food, Fuel & Fertilisers along-with normalisation of the market post pandemic correction, FMCG firms are fighting high input inflation while targeting growth, with demand diving because of low consumer purchasing power amidst inflation. Therefore, FMCG firms are stuck between devil & deep sea at the moment and this situation may last for another 1-2 quarters.

As per earlier post, while firms took some price increases in last few months and also resorted to cutting of pack sizes (grammage) while maintaining price points; the price increase so done is not sufficient to fully pass on the input inflation.

Please refer to below press clippings highlighting the situation:

Prospects for rural FMCG demand revival don’t look bright, yet

This post discusses that 'Between the twin engines of urban and rural markets that power FMCG sales, it’s the rural one that’s been giving more trouble. People long accustomed to it growing at multiples over urban growth are seeing it underperform. In the March quarter, for instance, rural markets saw volume growth decline by 5.3 percent or 1.7 times the decline seen in urban markets. But hopes are rising that the rural situation may stage a turnaround in FY23.

Small packs for big bucks: FMCG prices increase 10%

This post discusses on following points:

"Every kilogram of packaged consumer goods sold in India in February-April were 10% costlier than they were a year earlier following the rise in raw material prices, researcher Kantar said on Tuesday.

While the average per-kg price of fast-moving consumer goods (FMCG) jumped 10.1%, the average pack size shrank by nearly 15%, Kantar said in its June FMCG Pulse update. It reflected the attempts made by companies to cut product grammage to save on costs, it added. Grammage cuts were particularly pronounced in categories such as malted food drinks, salty snacks, soft drinks and hair oils. The number of FMCG packs bought rose 15% in the same period, indicating that as prices rose, consumers purchased smaller packs. To summarize, FMCG is starting to feel the pinch of high inflation, it said in a note.

Official data released on Tuesday showed India’s wholesale price-based inflation touched a record 15.88% in May compared to 15.08% in April. Price rise of mineral oils, crude petroleum and natural gas, food, basic metals, non-food articles, chemicals and chemical products, food products and others, were behind this high rate of inflation, the ministry of commerce and industry said.

Meanwhile, companies have been passing on higher input prices to consumers, impacting consumption as buyers move to smaller packs or shift to cheaper brands. Households are also facing inflation across a range of day-to-day items.

Overall, FMCG volumes declined 1.1% year-on-year in the three months ended 30 April 2022, while the sector reported value growth of 9% in the same period, Kantar said. April saw volumes decline 1.4%, the tenth straight month of decline in the last one year."

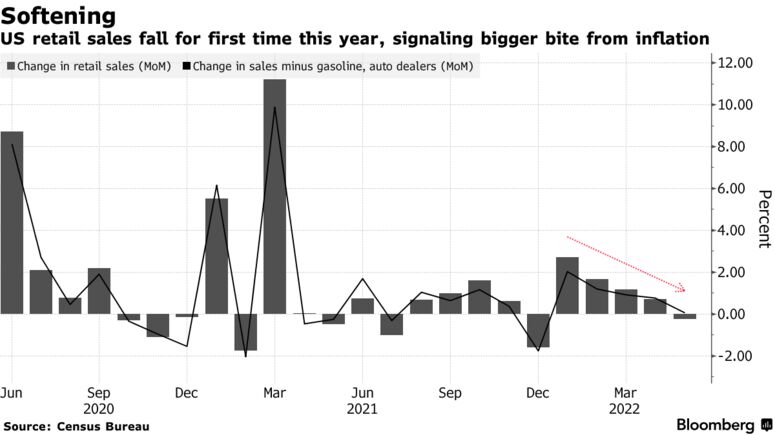

US Retail Sales Post First Drop in Five Months

Similar situation is observed in US as well as per the Bloomberg report stating drop in retail sales due to higher inflation.

Above press clippings provide an overview of the high-inflation situation and its repercussions on growth as well as profitability of FMCG firms.

In nutshell, FMCG firms are in a situation where they are seeing growth stagnating (or contracting depending on the categories) while margins are squeezed. This looks even more stark when compared with performance of last year, where due to relaxation of covid restrictions, there was much higher growth (albeit on lost sales of Q1-21) and bumper profitability due to lower input costs. Now, there is a double whammy and this pain shall last for 1-2 quarters.

With on-time arrival of monsoon and IMD's prediction of normal monsoons during the year, there is a hope of normalisation of inflation by Sep/Oct. Further, with start of the festival season in August, peaking during Oct/Nov, growth would also normalise.

0 Comments